The all-in-one platform for FinTech, securing your software and sensitive data from the first line of code to production. Prove robust protection and compliance to clients with ease.

Why do FinTech companies need App Security?

FinTech companies handle highly sensitive information and operate under intense regulatory pressure. A single exposed API key or a breach in a mobile application can lead to financial loss, regulatory penalties, and irreversible damage to customer trust. With distributed services, third-party integrations, and continuous deployments, maintaining real control and protection over your software is increasingly complex. The organizations you work with from banks to payment providers not only expect you to be secure, they will demand clear proof that you actually are.

ByteHide’s Solution

ByteHide unifies your software security within a single platform.

Compliance

Keep Your FinTech Compliance On Track

ByteHide helps you meet the technical requirements of leading regulatory frameworks like DORA, PSD2, ISO/IEC 27001, SOC 2 and PCI-DSS. From secure software development to runtime protection, our platform automates and strengthens the controls required to keep your applications compliant — from code to production.

Digital Operational Resilience Act

The DORA regulation requires financial institutions in the EU to ensure the operational resilience of their IT systems. ByteHide helps FinTech teams comply by protecting critical application logic, detecting vulnerabilities, and enabling real-time monitoring to manage third-party risks and operational continuity.

Revised Payment Services Directive

PSD2 demands strong customer authentication and secure communication across all digital payment services. ByteHide supports PSD2 compliance by protecting APIs, preventing reverse engineering, and ensuring your code and sensitive credentials remain secure even after deployment.

ISO/IEC 27001 – Info Security Management

This globally recognized standard focuses on the confidentiality, integrity, and availability of information. ByteHide helps enforce key technical controls required by ISO 27001, including secure handling of sensitive data, protection of source code, and real-time visibility into application behavior.

SOC 2 Type 2 – System and Organization Controls

SOC 2 evaluates how companies handle customer data in five trust principles: security, availability, processing integrity, confidentiality, and privacy. ByteHide supports your SOC 2 journey by implementing continuous protection, tamper detection, and access control enforcement across your app infrastructure.

PCI DSS – Payment Card Industry Data Security Standard

Organizations that process cardholder data must meet strict security requirements. ByteHide helps FinTech companies comply with PCI-DSS by protecting payment-related code, scanning for exposed secrets, and securing sensitive logic even in client-side and mobile environments.

Next-Gen Security Features

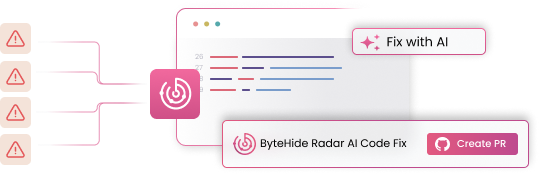

AI Static Code Analysis

Scans your source code for critical security vulnerabilities like SQL injection, XSS, and buffer overflows. AI-powered analysis reduces false positives by 85% and offers AI-driven autofix to remediate issues autonomously. Works out-of-the-box and supports all major languages.

Software Composition Analysis (SCA)

Analyzes third-party components (libraries, frameworks, dependencies) for vulnerabilities. Identifies and manages known CVEs, reducing supply chain risks.

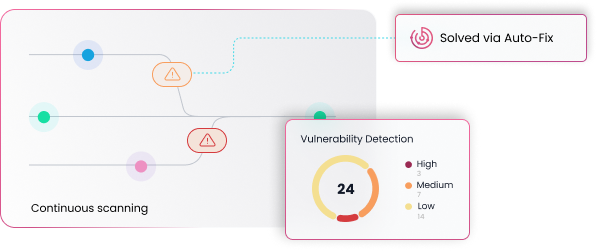

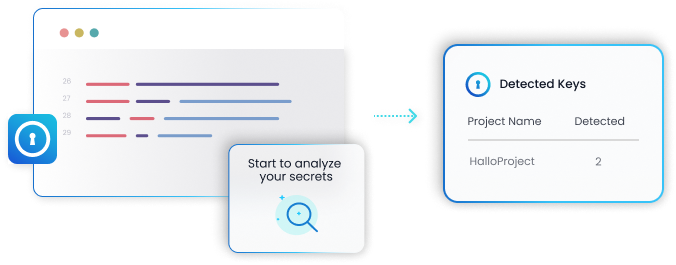

Secrets Detection

Scans your codebase, configurations, and repositories to detect hardcoded credentials, API keys, and sensitive information. Identifies and remediates exposed secrets before they become a threat.

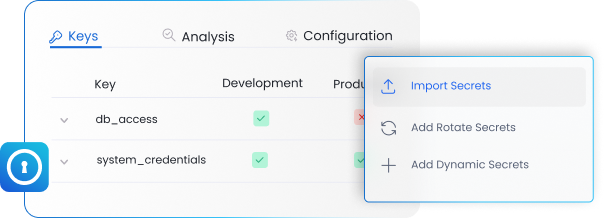

Secure Secrets Management

Provides a centralized, encrypted vault for storing and distributing API keys, database passwords, and other sensitive credentials. Reduces your attack surface and improves security posture.

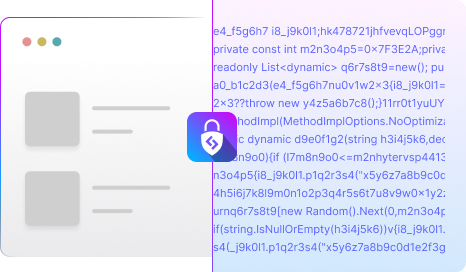

Code Security & Obfuscation

Safeguard your proprietary code and intellectual property from reverse engineering and tampering. Advanced code obfuscation techniques transform your application’s logic, making it extremely difficult for attackers to understand and exploit, while maintaining full functionality.

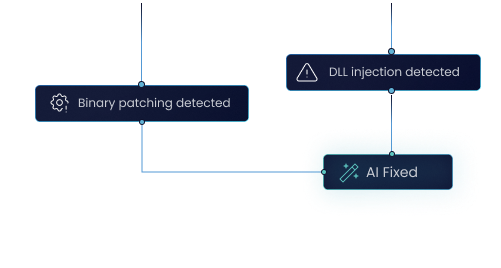

Runtime Protection & Monitoring (RASP)

Actively monitors and defends your applications against attacks at runtime. Immediately detects and blocks exploits like zero-day threats, injections, tampering, OWASP top 10 and unauthorized access. Ensures continuous application integrity without requiring code changes.

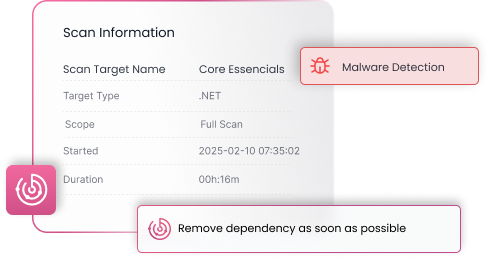

Malware Detection

Protects your software supply chain by detecting malware in dependencies, injected code, and third-party libraries. Proactively scans files and data your application manipulates, including those in storage, to ensure comprehensive protection against malicious threats and maintain system integrity.

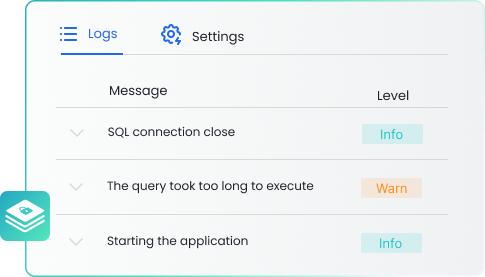

Secure Log Management

Centralizes, encrypts, and manages all your application and system logs. Ensures data integrity, provides irrefutable audit trails, and enables rapid incident response while protecting sensitive information.

Post-Quantum Secure Storage

Protects sensitive data against future cryptographic threats. Offers highly secure data storage leveraging advanced post-quantum encryption algorithms, ensuring confidentiality and integrity even against quantum computing attacks.

Application Security Posture Management (ASPM)

Gain a holistic view of your application security risks across the entire SDLC. ByteHide centralizes security findings from all modules (SAST, SCA, Secrets, Runtime) and contextualizes them to help you prioritize critical vulnerabilities, track remediation progress, and ensure continuous compliance.

Unboring FinTech AppSec for High-Growth Teams

Say goodbye to corporate security headaches. Bytehide streamlines FinTech application security, helping you fast-track code and compliance, while saving valuable time and money.

All-in-one

Secure your software from the first line of code to production. Our comprehensive platform integrates all necessary security tools into one seamless solution.

Up to 7x Faster

Dramatically accelerate fixes. Our AI leverages deep context across your entire security chain, eliminating false positives and autonomously fixing issues where other tools generate noise due to lack of insight.

Up to 65% Cost Savings

Achieve enterprise-grade security for significantly less. Reduce tool sprawl and operational overhead, cutting your AppSec budget while maintaining top-tier protection.

Frequently asked questions

Why are security, privacy, and total control so crucial for my FinTech application?

In FinTech, you handle highly sensitive financial and personal data. A breach can lead to financial losses, severe regulatory penalties, and irreversible damage to customer trust. ByteHide offers an all-in-one platform to protect your software from the first line of code to production, ensuring robust control over your data and its privacy.

How does ByteHide help my FinTech company comply with key security and data regulations?

ByteHide helps you meet the technical requirements of DORA, PSD2, ISO/IEC 27001, SOC 2 Type 2, and PCI-DSS. Our platform automates and strengthens the necessary controls to keep your applications and the data they handle compliant throughout the entire development cycle, from critical logic protection to secure credential management and real-time monitoring.

How does Radar (AI Static Code Analysis & SCA) protect data and ensure privacy in my FinTech code?

Radar detects vulnerabilities in your code (SAST) and in third-party components (SCA) that could expose sensitive data. The key is its local analysis: no code or compiled files are uploaded to our servers or leave your environment, and we do not store sensitive metadata. This ensures deep detection with maximum privacy.

How does Secrets (Secrets Detection & Management) guarantee credential security and prevent unauthorized data access?

Secrets detects sensitive credentials and keys (API keys, tokens) hardcoded directly in your code. It then automatically extracts them from the source code and manages them securely in an encrypted vault, eliminating the risk of exposure if your application is decompiled. This directly protects access to your systems and, therefore, to your sensitive data.

How does Shield (Code Security & Obfuscation) contribute to data privacy and FinTech logic protection?

Shield protects your intellectual property and your FinTech application’s code from reverse engineering and tampering. By making your application’s internal logic extremely difficult for attackers to understand and exploit, it indirectly safeguards how your application handles and processes sensitive data, preventing algorithm theft and unauthorized access to critical information.

How does Monitor (Runtime Protection & Monitoring - RASP) enhance privacy and protect data in FinTech apps?

Monitor protects your application from within, in real-time, even without an internet connection, which is crucial for distributed environments (mobile, IoT) where environment security is hard to guarantee. It detects tampering attempts, debugging, hooking, emulators, or rooted/jailbroken devices, all common tactics to access sensitive data or alter app behavior and its privacy controls. Furthermore, it removes sensitive information from memory after the application loads, strengthening privacy in operational environments.

What unique data privacy and security features does Storage (Post-Quantum Secure Storage) offer for FinTech data?

Storage stands out with its end-to-end encryption and a “Zero-Knowledge” model. Your data is encrypted in your application before being sent to the cloud, and only you have the keys to decrypt it. This ensures maximum privacy and regulatory compliance. It also offers environment-based encryption and temporary file management with expiration for granular control.

How does Logs (Secure Log Management) ensure data privacy and auditable control in FinTech operations?

Logs centralizes and securely stores your application’s records in the cloud. Logs are encrypted from your application until they reach our servers, and it allows for automatic masking of sensitive information within them. This ensures privacy in the records and provides complete, secure traceability of operations crucial for FinTech audits.

What is Application Security Posture Management (ASPM), and how does it optimize data protection in FinTech?

ASPM provides a holistic view of your security risks across the entire Software Development Lifecycle (SDLC). ByteHide centralizes security findings from all its modules (Radar, Secrets, Shield, Monitor, Storage, Logs) and contextualizes them. This helps you prioritize critical vulnerabilities that could lead to data exposure, track remediation progress, and ensure continuous compliance with privacy regulations.

How can ByteHide help my FinTech team achieve more efficient, faster, and cost-effective AppSec while protecting privacy?

ByteHide simplifies FinTech application security, helping you accelerate code and compliance while saving valuable time and money. Our all-in-one platform reduces complexity and tool sprawl, leading to up to 7x faster fixes thanks to AI, and up to 65% cost savings. By automating and unifying these security and data protection processes, your team can focus on innovation, confident that sensitive information’s security and privacy are robustly managed by an integrated solution.

Strengthen Financial Confidence

Protect your transactions, customer data, and critical business logic with ByteHide’s unparalleled security. Ensure your regulatory compliance and gain an irreplaceable competitive edge.

Strengthen Financial Confidence

Protect your transactions, customer data, and critical business logic with ByteHide’s unparalleled security. Ensure your regulatory compliance and gain an irreplaceable competitive edge.